On this page

↓ Capital budget↓ Breakdown of capital budget

↓ Operating budget

↓ 2026 household impact

The 2026 budget represents a continued strategic investment in Milton. Council identified Milton’s priorities through the development of the 2023-2027 Strategic Plan.

The plan envisions a diverse, welcoming community with higher densities supported by transit. This foundation includes transit system advancements, prioritized infrastructure, quality facilities, and a range of housing options in neighbourhoods where people can live and work close to nature.

The 2026 budget supports the Strategic Plan themes:

- Invest in people

- Innovate in technology and processes

- Quality facilities and amenities

- Connected transit and mobility

- Planned community growth

Capital budget

The capital budget funds construction and repair of Town infrastructure, including fleet and bus purchases, and corporate studies. The capital budget is funded from reserves and reserve funds, development charges, grants, and debt.

A growing municipality like Milton needs to invest in new infrastructure and the renewal of existing assets, such as roads, facilities, and parks.

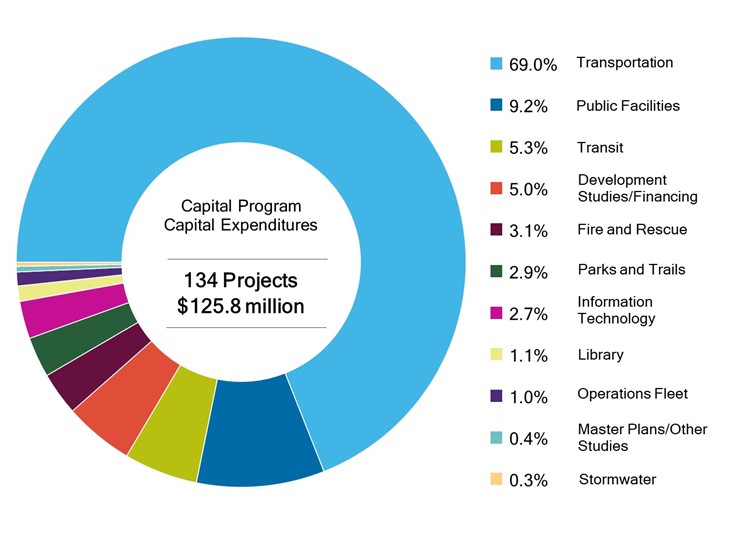

The 2026 capital program includes 134 projects, with a community investment of $125.8 million, to support programs and services in Milton.

The development of new assets and the rehabilitation of old infrastructure can be very costly. The Town continues to actively pursue available external funding opportunities to reduce the impact on taxpayers. In 2026, almost 71 per cent, or $88.7 million, of the capital program is funded from external sources, mainly development charges.

Capital budget expenditures

Below is a breakdown of the capital budget expenditures by service area:

Operating budget

The operating budget funds daily services, including winter road maintenance, grass cutting, recreation programs, and fire services. The operating budget also finances the Town’s capital projects through debt payments and transfers to reserves.

In 2026, the operating budget represents an investment of $236.9 million in the Town’s programs and services.

A large portion of the operating budget, 53.7 per cent, is funded from property taxes, while the rest is funded through user fees (19.4 percent), and other sources such as investment income, recoveries, etc.

Operating budget expenditures

Below is a breakdown of the operating budget expenditures:

2026 household impact

Property tax bills include amounts collected for the Town of Milton, Halton Region, and the Province (education/school boards).

The increase for the Town’s portion of property taxes is 6.94 per cent. With a 4.59 per cent increase for Halton Region and education rates estimated to remain at existing levels, the blended tax increase for 2026 would be approximately 4.75 per cent. The final total property tax rate can only be determined after finalization of the Provincial rate, as well as finalization of tax policy decisions.

See more details of this breakdown below.

|

Estimated household impact per $100,000 of residential assessment |

||||||

|

|

Share of tax bill |

2025 taxes |

2026 increase |

2026 taxes |

$ Impact on total tax bill |

% Impact on tax bill |

|

Town of Milton |

44% |

$354.68 |

6.94% |

$379.29 |

$24.61 |

2.98% |

|

Halton Region |

38% |

$318.32 |

4.59% |

$332.93 |

$14.61 |

1.77% |

|

Education |

18% |

$153 |

0% |

$153 |

$0 |

0% |

|

Total |

100% |

$826 |

4.75% |

$865.22 |

$39.22 |

4.75% |

Learn more about household impact and how your tax dollars are used.

Contact Us