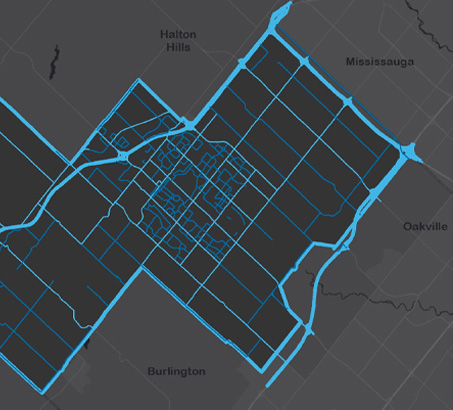

Development planning is all about shaping the future of Milton and making sure our Town grows in a way that benefits everyone. It involves creating plans for new buildings, neighbourhoods, parks, and businesses while protecting the environment and keeping our community safe and welcoming. Whether you’re a homeowner, business owner, or developer, understanding development planning is important if you’re working on a new project or making changes to an existing property.

On this page, you’ll find information about Milton’s development planning process, including how plans are reviewed, approved, and monitored. You can learn about the rules and guidelines for building and land use, as well as how to apply for approvals or permits for your project. Development planning helps ensure that all projects meet local standards and contribute to a well-designed, vibrant, and sustainable community.

Explore this page to find the resources and guidance you need to support your development goals while helping Milton grow and thrive!

You may also be interested in...

Contact Us