On this page

↓ Capital budget↓ Breakdown of capital budget

↓ Operating budget

↓ 2024 household impact

The 2024 budget represents a continued strategic investment in Milton. Council identified Milton’s priorities through the development of the 2023-2027 Strategic Plan.

This plan, a practical vision of the future, strives for a diverse and welcoming community defined by higher densities enabled by transit. This foundation will include transit system advancements, prioritized infrastructure, quality facilities and a diverse housing stock in varied neighbourhoods where people can live and work close to nature.

The 2024 budget aligns with the themes of the Strategic Plan, which include:

- Invest in people

- Innovate in technology and processes

- Quality facilities and amenities

- Connected transit and mobility

- Planned community growth

Capital budget

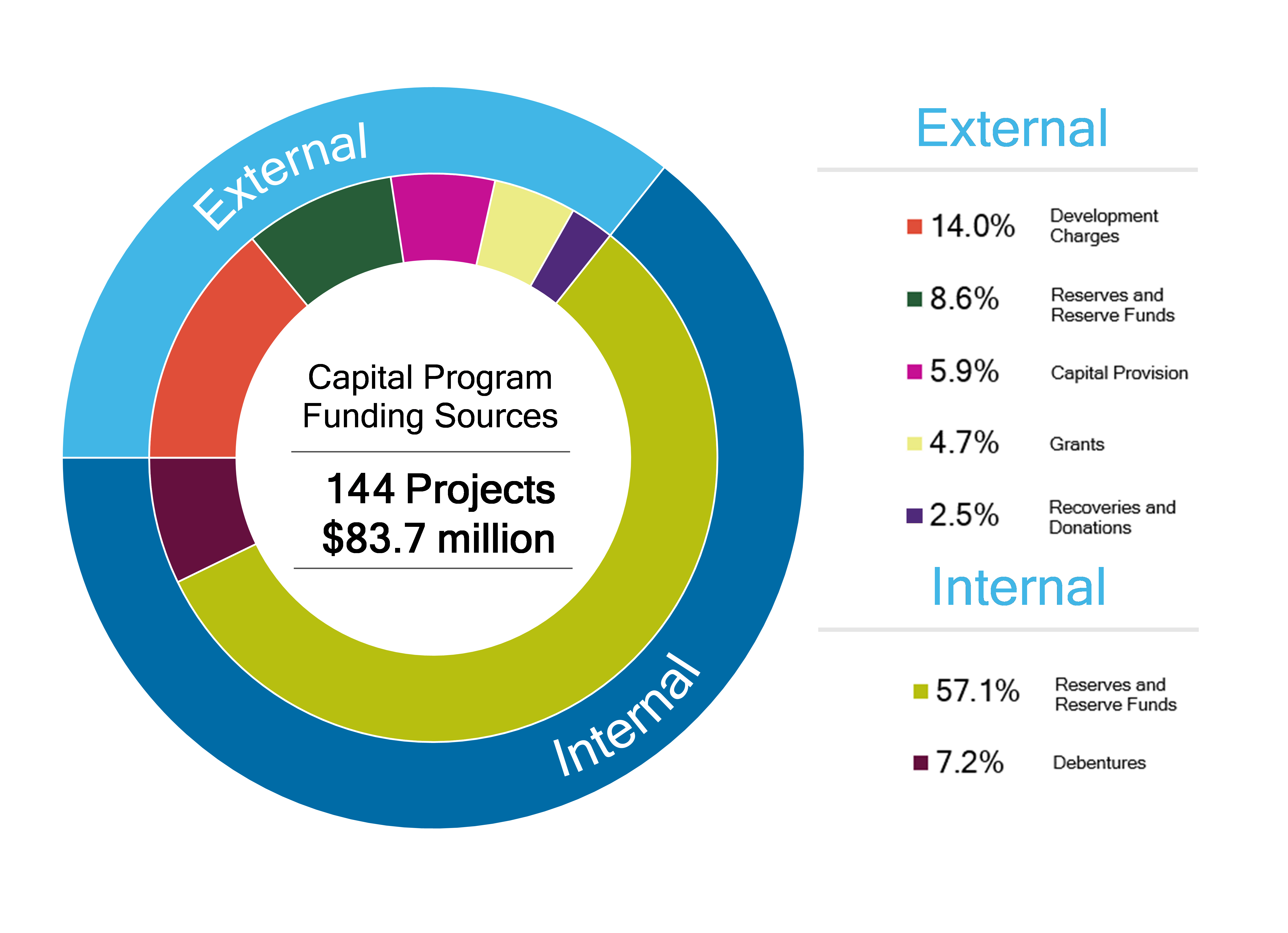

The capital budget funds construction and repair of the Town’s infrastructure, fleet and bus purchases, and corporate studies. The capital budget is funded from reserves and reserve funds, development charges, grants, and debt.

A growing municipality like Milton needs to invest in both new infrastructure and the renewal of existing assets, such as roads, facilities, and parks.

The 2024 capital program includes 144 projects, valued at a community investment of $83.7 million, to provide programs and services to Milton.

The development of new assets and the rehabilitation of old infrastructure, can be very costly. The Town continues to actively pursue all available external funding opportunities to reduce the impact on taxpayers. In 2024, over 35 per cent, or $29.9 million of the 2024 capital program is funded from external sources, primarily development charge revenue.

Breakdown of capital budget

The breakdown of funding for the capital budget includes:

Operating budget

The operating budget covers day-to-day spending on services such as winter road maintenance, grass cutting, recreation programs, and fire services. The operating budget also finances the Town’s capital projects through debt payments and transfers to reserves.

In 2024, the operating budget represents an investment of $192.5 million in the Town’s programs and services.

Property taxes cover a large portion of the operating budget, while the rest is funded through non-property tax revenues (provincial grants and subsidies, user fees). In 2024, 47 per cent of the operating budget is funded through non-property tax revenues.

2024 household impact

In 2024, the overall blended tax rate will increase by an estimated 5.93%. This represents the total impact on your property tax bill, combining taxes collected for the Town of Milton, Halton Region, and the Province (education school boards).

Viewed separately, this increase is comprised of a Town of Milton increase of 9.88%, a Halton Region increase of 5.06% and an estimated education increase of 0%. See more details of this breakdown below.

|

Estimated household impact per $100,000 of residential assessment |

||||||

|

|

Share of tax bill |

2023 taxes |

2024 increase |

2024 taxes |

$ Impact on total tax bill |

% Impact on tax bill |

|

Town of Milton |

41% |

$293.69 |

9.88% |

$322.71 |

$29.02 |

3.95% |

|

Halton Region |

39% |

$288.18 |

5.06% |

$302.76 |

$14.58 |

1.98% |

|

Education |

20% |

$153.00 |

0% |

$153.00 |

$0 |

0% |

|

Total |

100% |

$734.87 |

5.93% |

$778.47 |

$43.60 |

5.93% |

More information is available on household impact and value for tax dollar by understanding your tax bill.

Contact Us